Unlocking Opportunities for Young Professionals and First-Time Investors

My dear aspiring investor, welcome!

If you’re reading this, chances are you’re a young professional or someone new to the investment game, with your eyes set on the promising landscape of Nigerian real estate. And let me tell you, you’ve chosen wisely. For over two decades, I’ve seen the Nigerian property market grow, fluctuate, and ultimately, reward those who invested wisely and with foresight. It’s a journey, not a sprint, but with the right guide, you can certainly build lasting wealth.

Many Nigerians, especially in our vibrant cities, dream of owning property. It’s not just about shelter; it’s about security, legacy, and a tangible asset that often appreciates, even when other investments falter. But, for a beginner, the world of real estate can seem like a dense forest. Jargon, legalities, potential scams, and the sheer capital required can feel overwhelming.

Fear not! This comprehensive guide is designed to demystify real estate investment in Nigeria for you, the first-time investor. We’ll break down the essentials, offer practical advice, highlight what to look out for in 2025, and equip you with the knowledge to take your confident first step. Let’s make that property dream a reality!

Why Invest in Nigerian Real Estate? Understanding the Fundamentals

Before we go into the ‘how-to’, let’s solidify the ‘why’. Nigeria’s real estate market, despite its challenges, remains incredibly attractive for several fundamental reasons:

- Population Growth & Urbanization: With a population over 230 million and still rapidly growing, and millions flocking to urban centres like Lagos, Abuja, Port Harcourt, and Ibadan, the demand for housing and commercial spaces is perpetually high. More people mean more need for homes, offices, and retail outlets.

- Tangible Asset & Hedge Against Inflation: Unlike paper assets, real estate is a physical asset you can see, touch, and even live in. In an economy where inflation can erode savings, property often serves as a robust hedge, as its value and rental income tend to rise with inflation over the long term.

- Potential for High Returns: While not guaranteed, well-researched property investments in Nigeria can offer significant returns through rental income (rental yield) and capital appreciation (increase in property value over time).

- Diverse Investment Avenues: From residential to commercial, land banking to REITs, there are multiple ways to invest, catering to different risk appetites and capital sizes.

As a veteran in this field, I’ve always believed that “the best investment on Earth is Earth itself,” – an old adage that rings particularly true in Nigeria.

Now Let’s Lay The Groundwork: Before You Invest a Kobo

Rome wasn’t built in a day, and neither is a successful real estate portfolio. Your success hinges on thorough preparation.

a. Define Your Investment Goals

What do you want to achieve?

- Rental Income (Cash Flow): Are you looking for a steady monthly or annual income stream? If so, residential apartments, serviced apartments (as we discussed in our last chat, very hot right now!), or small commercial spaces might be your focus.

- Capital Appreciation: Are you hoping the property’s value will significantly increase over time, allowing you to sell it for a substantial profit? Land banking (buying undeveloped land and holding it), or properties in rapidly developing areas, would fit this.

- Personal Use & Investment: Perhaps you want a home for yourself that also serves as a long-term asset.

Knowing your ‘why’ will guide your ‘what’ and ‘where’.

b. Understand Your Financial Standing

- Budgeting: Be realistic about how much you can truly afford. This isn’t just about the purchase price. Factor in legal fees, agent commissions, survey costs, stamp duties, potential renovation costs, and initial maintenance.

- Tip: A common mistake beginners make is underestimating these ‘hidden’ costs. Always add an extra 10-15% to your estimated purchase price for contingencies.

- Financing Options:

- Personal Savings: The most straightforward, but it requires significant capital.

- Mortgages: Available through the Federal Mortgage Bank of Nigeria (FMBN) and commercial banks. Interest rates can be high, and eligibility criteria strict, but it allows you to leverage your capital.

- Cooperative Societies: Many workplaces and communities have cooperative societies that offer loans or facilitate land/property acquisition for members at more favourable terms. This is a very popular route in Nigeria!

- “Pay Small Small” Plans: Some developers offer installment payment plans directly, often interest-free over a period, which can be a fantastic way for young professionals to gradually own property. We also aggregate pay small small offers on our Finance page

- Real Estate Investment Trusts (REITs): This allows you to invest in a portfolio of income-generating properties without directly owning them. You buy units (shares) in the trust. This is excellent for diversifying and starting with smaller capital. We’ll delve deeper into REITs in another article, but know it’s an option.

- Crowdfunding: A growing trend where multiple investors pool funds to invest in larger projects. Look for reputable platforms with clear project details and legal frameworks.

c. Do Your Homework: Market Research is Key

This is non-negotiable. Don’t rely on hearsay or a friend’s ‘sure banker’ deal.

- Location, Location, Location: This timeless real estate mantra is even more critical in Nigeria. Research areas with:

- Developing Infrastructure: New roads, bridges, power projects, and even planned commercial hubs significantly boost property values. Think about how the Lekki-Epe Expressway expansion transformed areas like Ajah and Sangotedo.

- Amenities: Proximity to good schools, hospitals, markets, recreational centres, and places of worship adds value and attracts tenants.

- Security: This is paramount. A secure neighbourhood is always in higher demand.

- Growth Potential: Is the area experiencing an influx of businesses, young families, or government projects?

- Property Type: Are you interested in residential (apartments, duplexes, bungalows), commercial (shops, offices), or land? Each has its own dynamics.

- Current Market Prices: What are comparable properties selling for in your target area? Your MLS platform will be invaluable here, offering verified listings and market data!

Understanding the Nigerian Real Estate Ecosystem: Key Terms and Players

Navigating the market means speaking its language and knowing whom to trust.

a. Essential Real Estate Terminologies

- Certificate of Occupancy (C of O): The most recognized government-issued document confirming the legal ownership of land for a specific period (usually 99 years). A must-have!

- Deed of Assignment: A legal document that transfers ownership of a property from the seller to the buyer. It details the transaction.

- Governor’s Consent: For land with an existing C of O, the Governor’s approval is mandatory for a transfer of ownership to be legally binding. This is crucial.

- Survey Plan: A map showing the exact dimensions, location, and boundaries of a parcel of land. Essential for identifying your plot and avoiding encroachment.

- Excision/Gazette: Land that has been formally removed (excised) from government acquisition and published in a government gazette is safe for private purchase.

- Rental Yield: The annual return on investment from rental income, expressed as a percentage of the property’s value. (Gross Rental Yield = Annual Rental Income / Property Value. Net Rental Yield = (Annual Rental Income – Expenses) / Property Value.)

- Capital Appreciation: The increase in the market value of a property over time.

- Due Diligence: The thorough research and investigation conducted before purchasing a property to verify its authenticity, ownership, and absence of encumbrances. This is your shield against fraud!

b. Who to Trust: Essential Professionals

- Verified Real Estate Agents/Realtors: They connect buyers and sellers, provide market insights, and facilitate transactions. Always work with agents registered with relevant bodies and those who come highly recommended. Our MLS platform will be your go-to for finding reputable professionals.

- Real Estate Lawyers: Absolutely non-negotiable! A good property lawyer will conduct thorough due diligence, verify documents, draft agreements, and ensure your investment is legally sound. They are your primary defence against fraud.

- Surveyors: Essential for verifying land boundaries and ensuring your property matches the survey plan.

- Property Valuers: If you’re unsure about a property’s market value, a professional valuer can provide an accurate assessment.

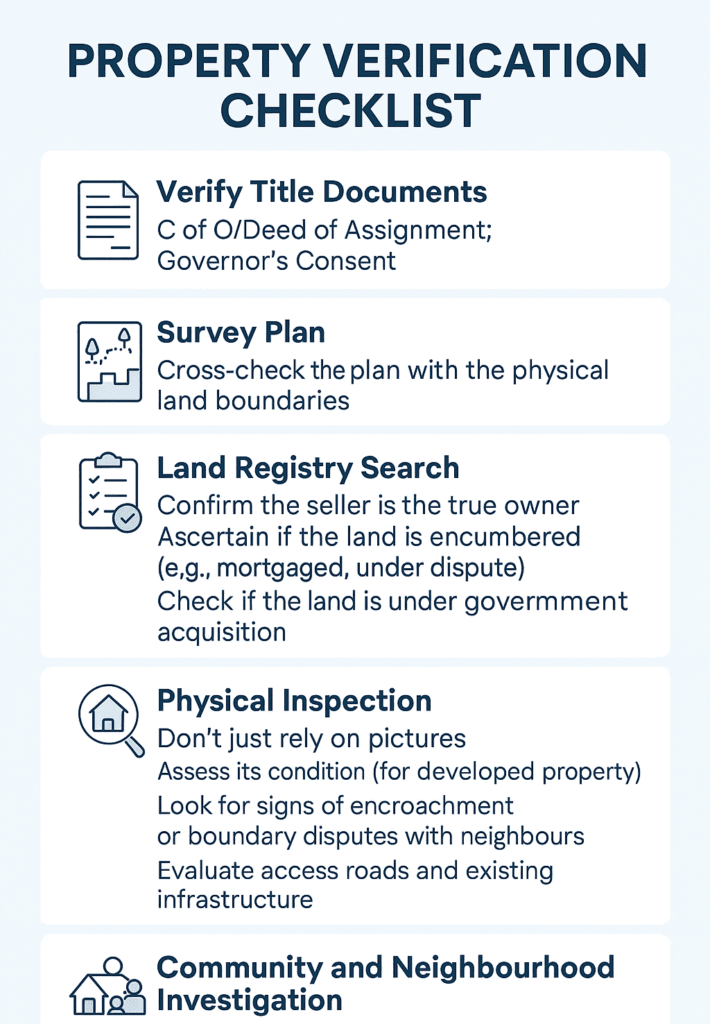

Due Diligence: Your Shield Against Property Fraud

This is arguably the MOST important section for any beginner in Nigeria. Property fraud and land disputes are unfortunate realities. Thorough due diligence is your strongest defence.

The Due Diligence Checklist:

- Verify Title Documents:

- C of O/Deed of Assignment: Ensure these documents are authentic and registered at the relevant State Land Registry.

- Governor’s Consent: If applicable, confirm it has been duly obtained.

- Survey Plan: Cross-check the plan with the physical land boundaries.

- Land Registry Search: Your lawyer MUST search the State Land Registry (e.g., Lagos State Lands Bureau) to:

- Confirm the seller is the true owner.

- Ascertain if the land is encumbered (e.g., mortgaged, under dispute).

- Check if the land is under government acquisition. This is a common pitfall! Many unsuspecting buyers lose money because they purchased land designated for public projects.

- Physical Inspection: Don’t just rely on pictures. Physically inspect the property and its surroundings.

- Assess its condition (for developed property).

- Look for signs of encroachment or boundary disputes with neighbours.

- Evaluate access roads and existing infrastructure.

- Community and Neighbourhood Investigation: Speak to locals, community leaders, and neighbours.

- Inquire about security, amenities, and any recurring issues (e.g., flooding, land disputes).

- Understand the local customs and if there are any community claims on the land.

- Engage Professionals: As stressed earlier, your lawyer, surveyor, and agent are your eyes and ears. Do NOT cut corners on professional fees here; it’s a small price to pay to protect a major investment.

A common phrase in Nigeria: “If the deal is too good to be true, it probably is.” Be wary of unrealistic offers and high-pressure sales tactics. Take your time.

Types of Real Estate Investments for Beginners

Now, let’s look at what you can actually put your money into.

a. Land Banking

This involves buying undeveloped land, holding onto it for several years, and selling it for a profit as its value appreciates due to development in the area.

- Pros: Lower entry cost than developed property, significant capital appreciation potential.

- Cons: No immediate income, tied-up capital, risk of government acquisition if not properly excised, slower returns.

- Best for: Investors with patience and long-term capital appreciation goals. Look at areas in the Ibeju-Lekki axis, Epe, and certain parts of Abuja’s satellite towns for potential growth in 2025 and beyond.

b. Residential Properties (Buy-to-Let)

Investing in apartments, bungalows, or duplexes to rent out for rental income.

- Pros: Steady income, potential for capital appreciation, and tangible asset.

- Cons: Property management headaches (unless you hire a manager), maintenance costs, potential for vacant periods.

- Best for: Investors seeking consistent cash flow. Areas like Lekki Phase 1, Ikoyi, Victoria Island (Lagos), and Wuse II, Gwarinpa (Abuja) consistently attract tenants, though yields vary.

c. Serviced Apartments

These are fully furnished apartments offering hotel-like amenities and services. (We covered this in detail before, remember?)

- Pros: High rental yields, attractive to short-term tenants (business travellers, digital nomads, diaspora), professional management often available.

- Cons: Higher initial setup cost due to furnishing, requires quality management.

- Best for: Those seeking higher rental income and less direct management hassle.

d. Commercial Properties

Investing in office spaces, retail outlets, or warehouses.

- Pros: Typically higher rental yields and longer lease terms than residential properties.

- Cons: Higher initial capital, market fluctuations tied to economic cycles, specific tenant needs.

- Best for: Investors with higher capital and a good understanding of business needs.

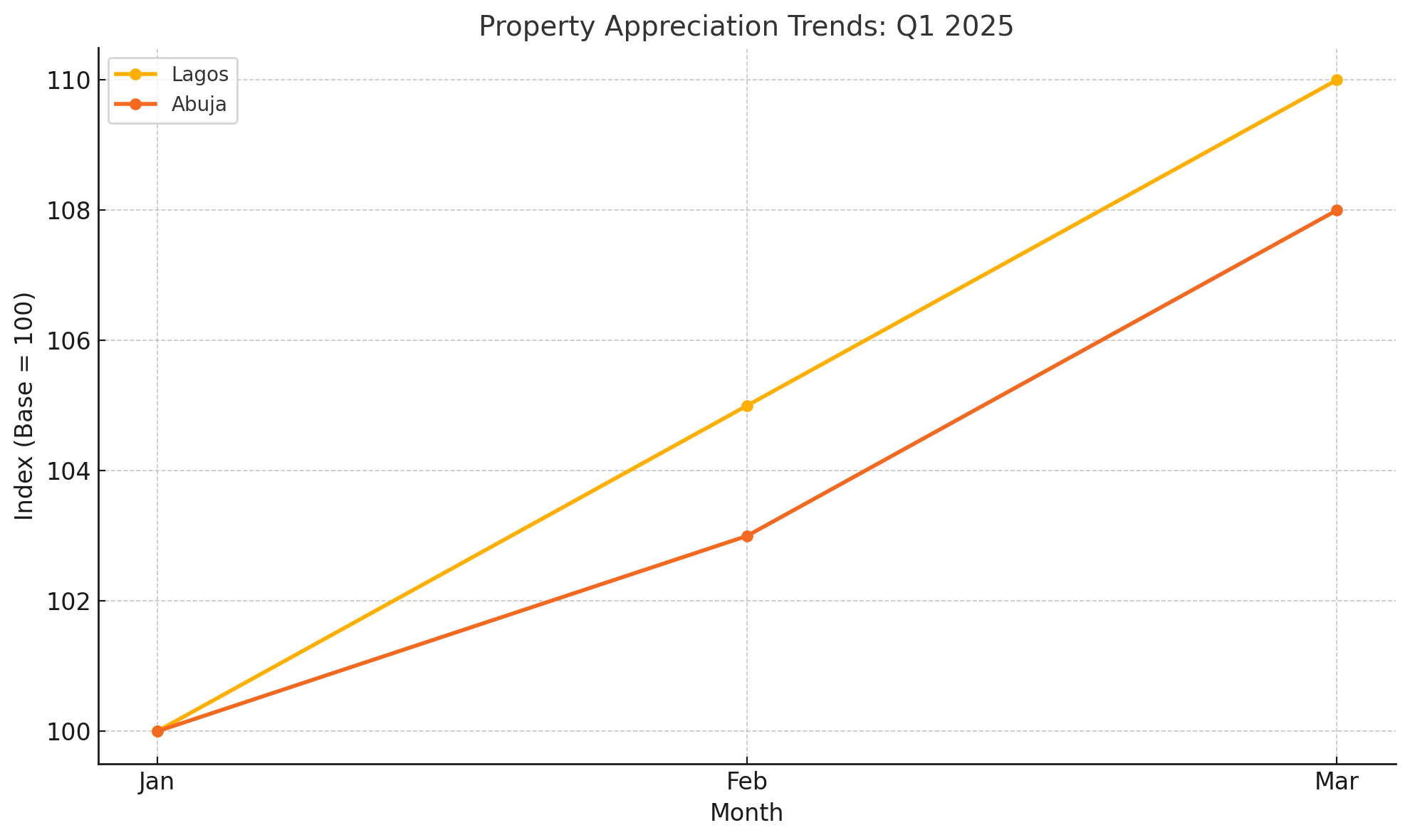

Market Trends & Predictions for 2025: What the Experts are Saying

As of May 25th, 2025, the Nigerian real estate market continues its dynamic dance, influenced by economic reforms, infrastructure projects, and shifting demographics.

- Inflationary Pressures: While headline inflation remains a concern, real estate’s ability to hedge against it means property values in prime locations are generally holding steady or even appreciating. The cost of building materials, however, continues to influence new developments.

- Infrastructure Impact: Major projects like the ongoing coastal road project in Lagos, new rail lines, and improvements in power supply are poised to significantly increase property values in their corridors.

- Expert Insight: “Infrastructure is the silent driver of real estate value. Any area seeing significant government or private investment in roads, power, or transportation networks is an area where property appreciation is almost guaranteed in the medium to long term,” observed Mr. Kunle Awolowo, a leading Real Estate Consultant in Lagos, during a recent industry forum on May 20, 2025.

- Residential Demand: The demand for affordable housing remains high, especially in the middle-income bracket. Areas offering a good balance of affordability, infrastructure, and security are seeing strong interest.

- Rise of PropTech: Technology is increasingly streamlining real estate processes. Platforms like our MLS database are transforming how buyers find verified listings, perform virtual tours, and access market data, making investments more transparent and accessible. This is a game-changer, especially for young, digitally-savvy investors.

Here’s a general snapshot of estimated property appreciation across prime Nigerian cities (May 2025, annualized):

| City/Location | Estimated Annual Appreciation (%) | Key Drivers |

| Ikoyi/VI, Lagos | 8% – 15% | High demand, prime location, limited supply, luxury market |

| Lekki Phase 1, Lagos | 10% – 18% | Developed infrastructure, amenities, and high middle-class demand |

| Ibeju-Lekki/Epe, Lagos | 15% – 25%+ | Mega projects (Dangote Refinery, Seaport, Airport), future growth hub |

| Maitama/Wuse II, Abuja | 7% – 12% | Stable, high-income residential/commercial demand, government presence |

| Gwarinpa, Abuja | 10% – 16% | Growing middle-income area, increasing amenities, good connectivity |

| Trans-Amadi/GRA, Port Harcourt | 6% – 10% | Oil & gas sector influence, established residential/commercial zones |

Avoiding Common Pitfalls for First-Time Investors

Even with the best intentions, beginners can stumble. Learn from the mistakes of others:

- Skipping Due Diligence: We’ve hammered this point home because it’s the biggest mistake. Never, ever, assume. Verify every document, every claim.

- Emotional Buying: Don’t let sentiment override sound financial judgment. Stick to your research and budget.

- Ignoring Professional Advice: Don’t try to be a ‘sharp guy’ and cut out lawyers or reputable agents. They are your safety net.

- Lack of Long-Term Planning: Real estate is generally a long-term investment. Don’t expect quick riches, and have a clear strategy for holding or exiting.

- Underestimating Additional Costs: As mentioned, legal fees, agent commissions, survey, stamp duties, potential renovations, and ongoing maintenance must be factored in.

- Falling for Scams: Be wary of deals that seem too good to be true, unregistered agents, or properties without clear documentation. Always insist on seeing original documents.

The MLS Advantage: Your Partner in Smart Investing

It’s challenging to find valuable and good information out there; having access to verified, up-to-date information is your competitive edge. That’s where a robust MLS (Multiple Listing Service) database comes in. Our platform is designed to be your trusted partner, offering:

- Verified Listings: Say goodbye to endless searches and questionable listings. Our platform features properties that have undergone a rigorous verification process.

- Comprehensive Data: Access to real-time market data, price trends, neighbourhood insights, and detailed property information.

- Reputable Professionals: Connect with certified and trusted real estate agents, lawyers, and surveyors who can guide you every step of the way.

- Transparency: We believe in making the real estate journey as clear and transparent as possible, empowering you with the knowledge to make informed decisions.

This level of transparency and access to verified information is truly transforming the Nigerian real estate landscape, making it safer and more efficient for everyone, especially for first-time investors like you. It’s about levelling the playing field and ensuring you have the best possible start.

Your Journey Starts Now!

Investing in Nigerian real estate in 2025 is an exciting prospect, brimming with opportunities for those who are prepared and well-informed. It requires patience, diligence, and the right guidance. By understanding your goals, doing your homework, leveraging the right professionals, and utilizing platforms like ours, you are already well on your way to building a successful property portfolio.

Remember, every seasoned investor started as a beginner. The key is to start right, stay informed, and avoid the common pitfalls. The wealth generation potential in Nigerian real estate is immense, and I’m here to help you unlock it.

Ready to take your first confident step into the world of Nigerian real estate investment?

Sign up for our newsletter today to receive exclusive access to verified property listings, in-depth market analysis, expert webinars, and practical tips tailored for the Nigerian real estate investor. Let’s build your property success story together!